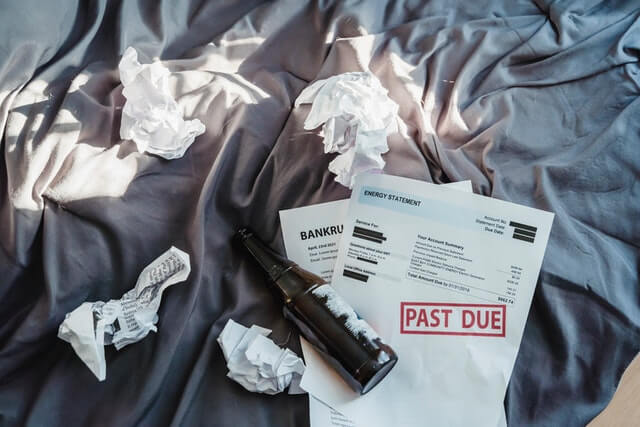

With the ongoing pandemic, money has been tight for everyone. The rising cost of gas, food, and rental rates are taking a toll on everyone’s finances. In 2021, 90,092 consumers filed for insolvency in Canada. It is financial instability, wherein a person cannot pay off his debts due to various reasons.

Whenever we hear someone go bankrupt, our immediate thought is that they do not have enough finances to support their daily needs. A person who files for bankruptcy is enough reason for landlords and agents to back off. I’m sure you would not want to recommend an applicant with doubtful means. However, do bankrupt tenants have no chance of renting a home?

Recognizing Bankruptcy and Its Causes

Before you write off the tenant, you have to know and understand the reason for their financial status. There are several reasons why someone would file for bankruptcy. We must consider why they filed because it may have been a one-time thing and is unlikely to happen again. In Canada, the top five causes are:

• Job loss

It is not a secret that many people lost their job during the pandemic. Businesses had to shut down or cut their expenses to survive. The result was a rise in the unemployment percentage in the country. Fortunately, the pandemic problem is slowly dissipating, and the world is recovering.

• Medical bills

An unforeseen major medical illness is one of the reasons why someone could go bankrupt. Aside from them not being able to work, some insurances do not cover all health-related problems. The time off work to recover would drive someone to use their credit cards to cover their daily expenses.

• Unexpected events

Unpredicted tragedies can sometimes result in bankruptcy. Examples of these are fire disasters, major car or home repairs, and sudden deaths. Without enough insurance and savings, the expenses will become overwhelming for them.

• Divorce

A study showed that divorce was the leading cause of bankruptcy in the country, with 14% of the people who filed. The legal costs of processing the separation do not come cheap. Aside from the legal fees, some have to give their spouses financial support with their income.

• Mismanagement of finances

Some people tend to abuse the use of their credit cards. They enjoy the feeling of getting something without having to cash out. It is also the reason why they go bankrupt. They tend to forget about limiting their spending habits because credit cards make it easy.

Background checks

Even if a tenant applicant has a history of bankruptcy, we can still consider them as potential clients. The best thing for you is to do a thorough background check on the tenant. You can check the essential details such as their employment status, proof of income, and credit scores. If their line of work is periodic or seasonal, it will show that they might have a hard time paying rent and other fees.

You can also investigate their rental history. Was the tenant paying the rent on time before filing for bankruptcy? You can contact at least two past landlords to find out their rental habits. The information will help paint a picture of their ability to be responsible for their payments.

Protecting the rental

I know the risks that come with renting to a bankrupt tenant. However, there are ways for landlords to protect their investments. One of the things you can ask from the applicant is to have a co-signer with good credit status. The co-signer is responsible for paying the rental costs if the tenant cannot.

The landlord can also ask for a bigger security deposit. It will give them peace of mind knowing the tenant can afford to pay to secure the rental.

Bankruptcy does not necessarily mean the tenant cannot financially support themselves anymore. Sometimes unfortunate events happen that they fall behind their finances. We should check first before rejecting them. You must know this because you might probably encounter these applicants.

But if you think you can find someone with better financial standing, you can do so. Make sure to use websites like Padleads for that. Sign up, post your property listings, and syndicate them to other pages. It will give you more options.