Burglary can happen anytime, whether it be in a private home, rental apartment, or business establishments. Burglary is the crime where a burglar enter’s a person’s property and steals items. The intent is to get something of high monetary value or money itself. Some burglars force their way in (e.g. breaking a window) or enter through unlocked doors.

When burglary occurred in an apartment rented by a tenant, it will also be the landlord’s problem. The landlord must work together with the tenant and local authorities in dealing with the situation. A landlord can help the tenant claim a renter’s insurance coverage for the stolen items.

What is renter’s insurance?

A renter’s insurance (a.k.a. tenant’s insurance) is insurance purchased by the tenant as an occupant of a property he doesn’t own. It will cover financial obligations if they need to pay for repairs for damages they have caused to the rented property. The coverage could also include their valuable possessions like jewelry, gadgets, and clothes in the event of natural calamity or burglary.

The Odds of Burglary

The Federal Bureau of Investigation record millions of burglaries in the United States every year. Three of the most common ways burglars enter a property are through the front door, back door, or garage. Contrary to popular belief, most break-ins happen during the daytime because that is the time when properties are empty because occupants leave for work or school. Burglars often check for signs that a property is unoccupied, such as uncollected mail or newspapers on the front porch. They also prefer properties that have entry points that are not visible to neighbors.

There is a high probability that many landlords and tenants would experience burglary because of how prevalent it is.

Insurance Deductible

When a tenant becomes a victim of burglary, his stolen possessions will be covered by the renter’s insurance.

However, one thing to note about renter’s insurance is that it often has an agreed-upon deductible, which is the amount of money a tenant must pay out of pocket when claiming for insurance. For example, the deductible that was set on the tenant’s insurance is $300. If the total worth of the stolen items is $700, the insurance will only give the tenant $400 because the first $300 is the tenant’s responsibility.

If a tenant doesn’t have many high-value possessions, he will not benefit from the insurance if his deductible is $1,000 when his only possession that a burglar would most likely steal is his 500-dollar phone.

Property Damage

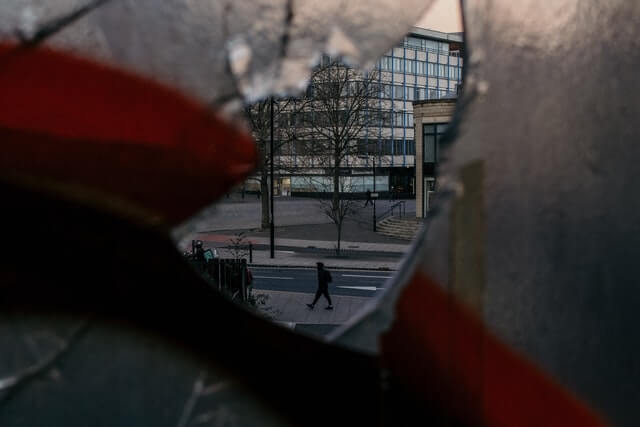

Burglaries and property damage often come hand in hand. A burglar often gains entry to a property by breaking a glass window or kicking down a door.

The cost of repair for such damages can be covered by the landlord’s insurance. However, if the cost of repair is less than the deductible indicated on the landlord’s insurance policy, then landlords should not bother making a claim and instead spend on the repair on their own. Property damage for burglaries is often minimal because burglars do not need to blow up the property just to get in.

Liabilities

There are instances when burglaries and insurance claims are harder to resolve because there is an element of negligence on the part of the tenant or landlord. Here are a few examples:

• There were requests for window, door, or lock repairs that the landlord failed to address promptly, making it easier for burglars to enter the property.

• The tenant forgot to lock his door upon leaving for work.

• The tenant failed to inform the landlord of the broken alarm system.

• The landlord failed to put up additional security measures despite a history of burglaries in the property.

Requiring Tenant’s Insurance

Most states (except Oklahoma) allow landlords to require tenants to have renter’s insurance. They can even require a minimum coverage amount. Landlord’s and renter’s insurance is a good combination so that all parties will be protected from financial loss after a burglary.

Whenever a rental agent publishes a listing on Padleads, he would have to screen the applicants. If they show the willingness to have renter’s insurance after learning that the landlord requires it, it’s a good sign that they are responsible renters, making it easier for the rental agent to find the best tenants.